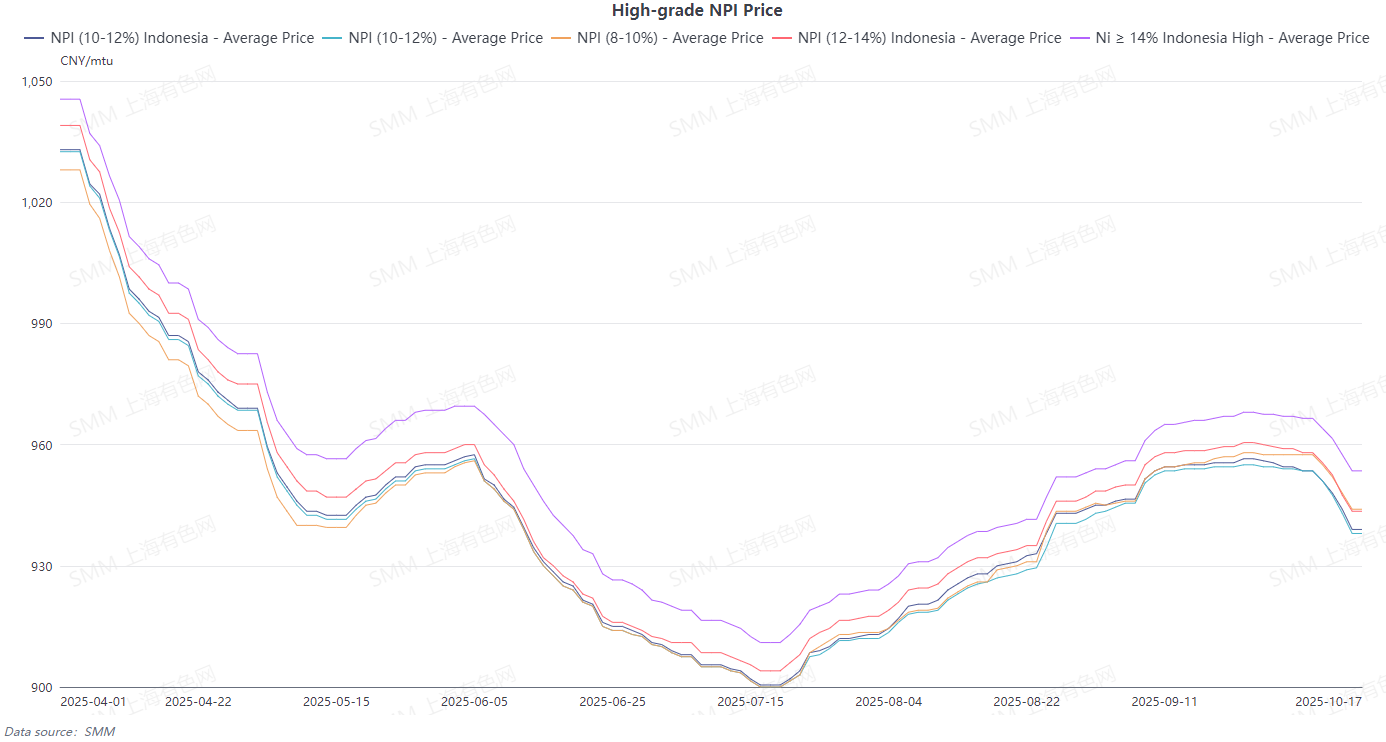

The average price of SMM 10-12% high-grade NPI fell 10 yuan/mtu WoW to 943.5 yuan/mtu (ex-factory, tax included), while the average Indonesian NPI FOB index price dropped $1.14/mtu WoW to $116.02/mtu. Following the downward adjustment in tender prices by mainstream steel mills, most downstream stainless steel mills drove down prices. Coupled with consecutive declines in stainless steel futures and improved cost-effectiveness of stainless steel scrap, high-grade NPI faced pressure, leading to a noticeable price drop this week.

Supply side, with rising ore prices, high-grade NPI cost lines remained firm. Current prices are approaching the full cost of Indonesian high-grade NPI, but due to weak end-use demand, smelter offers continued to decline. Demand side, stainless steel futures fell, putting downstream profit margins under pressure, with recent offers and some transaction prices showing significant declines. Overall, high-grade NPI production costs are still supported by ore prices, but under pressure from weak end-use consumption, prices are expected to remain under pressure within the month.

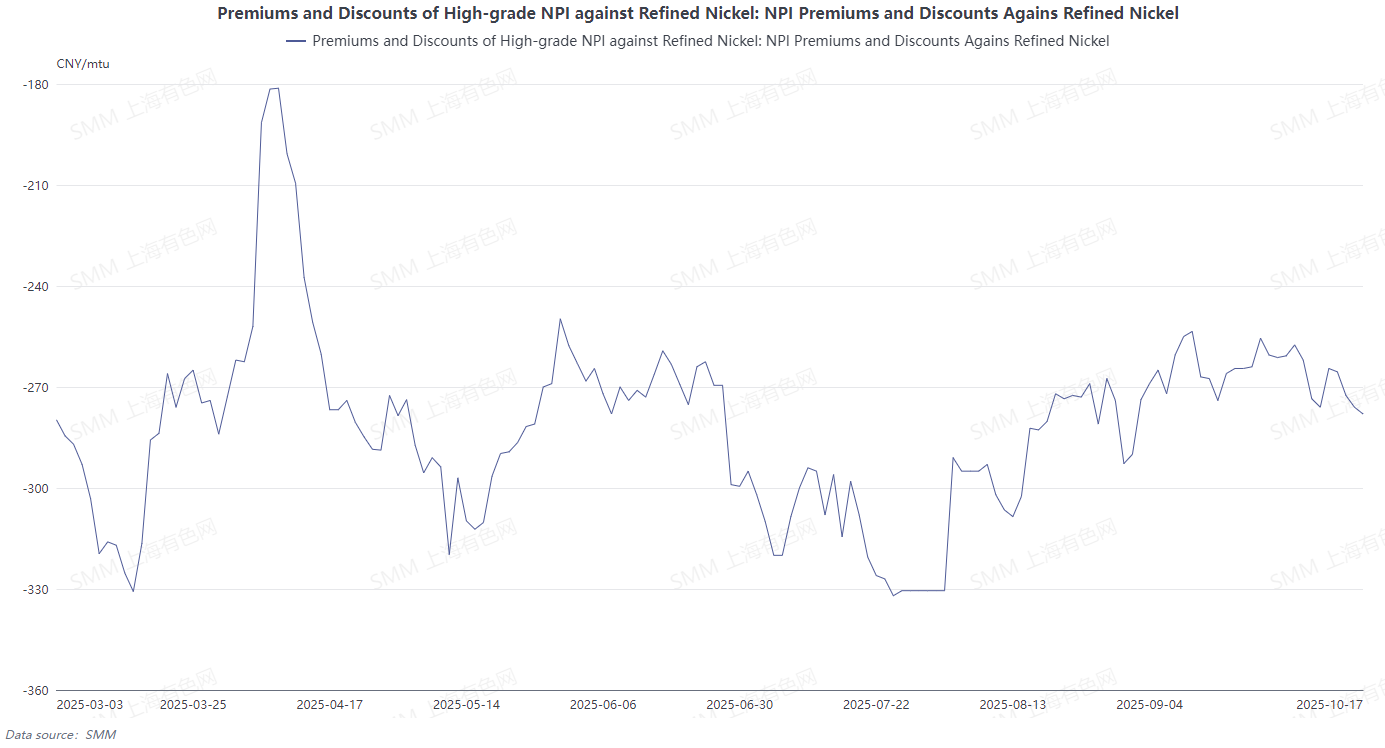

This week, the price center of refined nickel moved lower, and high-grade NPI prices also pulled back noticeably. The average discount of high-grade NPI to refined nickel narrowed slightly WoW to 271.3 yuan/mt. High-grade NPI prices are expected to remain under pressure next week, while refined nickel prices are projected to decline MoM. The average discount of high-grade NPI to refined nickel is likely to stay stable, but due to shortages of nickel sulphate raw materials, conversion of high-grade NPI to high-grade nickel matte is expected to increase MoM.

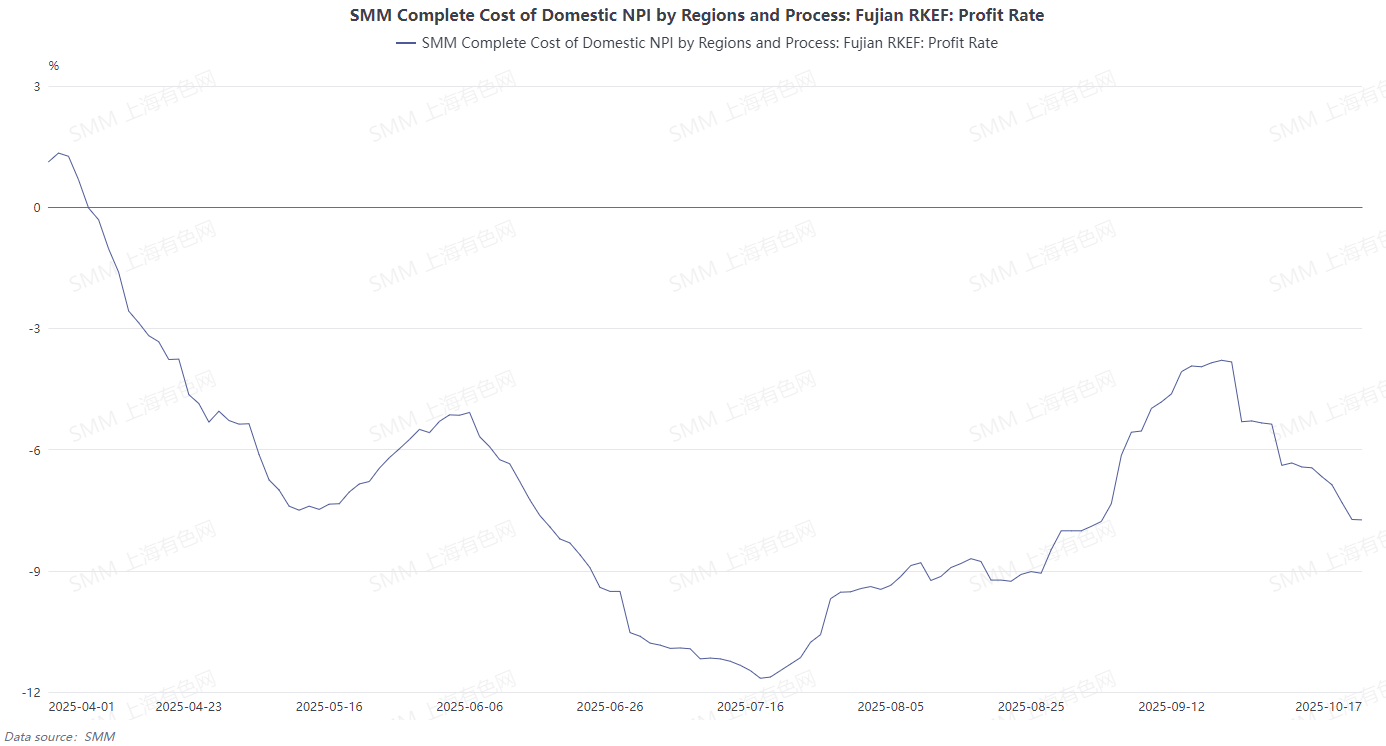

Based on nickel ore prices from 25 days ago for calculating the cash cost of high-grade NPI, smelter profits declined this week. Raw material side, Philippine ore prices are expected to rise, Indonesian ore prices increased WoW, and auxiliary material prices rose again, pushing up high-grade NPI costs. Meanwhile, consecutive declines in high-grade NPI prices led to lower smelter profits. Looking ahead to next week, raw material side, auxiliary material prices rose again, Philippine nickel ore prices are expected to potentially increase, and high-grade NPI prices are projected to continue falling, suggesting smelter profits will remain under pressure.

![[SMM Analysis] Influenced by macro sentiment, MHP and high-grade nickel matte prices declined this week.](https://imgqn.smm.cn/usercenter/CWsEw20251217171732.jpeg)